Some of the most popular and interesting industries nowadays are shareholding, investment, and trading. There are so many different ways you can do this, and if you make the right choice, you can easily make a lot of profits. Lately, spread betting has become something that many people are interested in, but not everyone knows what it is and how it works.

In this 2024 guide, we are going to tell you more information on this financial activity, and we will mention the advantages and disadvantages of it. Know that no matter if you choose to do this as a full-time job, or if you want to be just a spectator, the more knowledge and information you have, the better chances you have to make some profits.

What is it?

By definition, the spread is the variance between buying a selling product, item, or an action, and all of that revolves around the retail price or merit of the product. The costs between these two numbers, also known as the offer and the bid, are also factored into the final price or retail merit.

To make things even, and so that every product can make profits for those who are selling it, the price of it will always be lower than the market one when you sell it, and it will always be higher when you are buying it.

When it comes to spread betting, this is the process in which people, usually brokers speculate on the price. They can speculate on everything, including cryptocurrencies, shares, treasuries, and even commodities.

The brokers can hypothesize on both the selling and the buying value of these things, and they can choose to do the guess on one of them, two or to speculate about everything that might change, and how it will affect the global market.

This is not a simple thing to do and requires a lot of knowledge and analysis. People spend years, maybe even decades to learn how to make the right guess that will lead to potential profits. Know that there are two main types, daily and quarterly.

When it comes to the former, they will run as long as you choose to leave them open. They are best used when the brokers bet on shorter motions, and not on something that will affect the market in the long run. On the other hand, quarterly wagering is the process in which the wager will expire at the end of four months. They are done three times per year, usually, though this can vary depending on the market and other things. In some cases, you can make your wager in advance for the next quarter or year, but you have to make that known to the platform or place where you make your wager beforehand. Not every platform allows you to make your predictions in advance, so if you are interested in doing this, you will have to choose the right place.

Things you need to know about the process

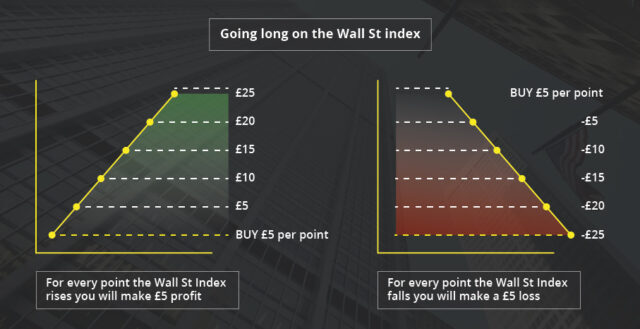

This financial product will allow you to wager if the retail will rise or fall, so if you make the right choice or assumption, you will be able to monetize your thoughts. The good thing about this is that you can choose between some really big names and products, and you never own what you are wagering on. According to themerrymarkets.com, this means that you cannot lose valuable assets, and you can still make your assumption on stocks, including big market names like Apple, Microsoft, or Mercedes.

On the same note, you can make your speculation on anything, including bonds and brands, but you are not allowed to wager on things that you own. This is done to make sure that everything is legal, and that you won’t crash your company on purpose, especially if it is near bankruptcy. You can easily take advantage of the retail price or the overall market, and it is said that every person is allowed to be a part of this industry. However, you need previous knowledge, and the right platform to be able to make your wagering.

The way this whole thing works is simple, you just place your wager on what you think is going to happen to the retail value, and you want to see if you made the right guess, and you are going to make some money out of it, or if you were wrong, and you are going to lose your initial investment.

Pros and cons of the process

There are a lot of things that are seen as advantages, and some are seen as negatives when it comes to spread betting.

The main pro is that when you make your profits, you are not obliged to pay taxes on them. There are no commissions, and you don’t have to invest a lot to leave with a lot of cash. You don’t have to do it every day, and you are the one who chooses when they want to place their wagers and on what. With the technology we have nowadays, you will be able to get as much support as possible, and the platforms used are user-friendly and easy to understand. Last, but not least, there is no commission on the stocks, and you will be able to go short with ease.

When it comes to the negative sides of this industry, the main one is that you can have unlimited losses. Because of this, you need to be aware of the risk and manage them. You should take all the measures needed to stop the unlimited losses and take control of the risk. Note that when you are trading cash items, the quotes on the price are usually shorter than the ones in the spread.

These are some of the things you need to know about this financial process. If you determine to pursue it as a profession, you should contact a stockbroker that can tell you more about the whole process, what you should do, and how to avoid probable losings.